23+ fha mortgage insurance

Known as a Section 232 loan these loans help finance nursing homes assisted. Get Home Warranty Quotes By Zip.

Scott Simpson Branch Manager Vice President Holmdel Nj Jersey Mortgage Company

Web To provide mortgage insurance for a person to purchase or refinance a principal residence.

. However this will increase your monthly. Weve Helped Over 280000 Homeowners Compare Quotes From Top Insurance Companies. Web Mortgage insurance lowers the risk to the lender of making a loan to you so you can qualify for a loan that you might not otherwise be able to get.

It equals 175 of the loan amount. Many or all of the products featured here are from. Web HUDFHA provides mortgage insurance on loans that cover residential care facilities.

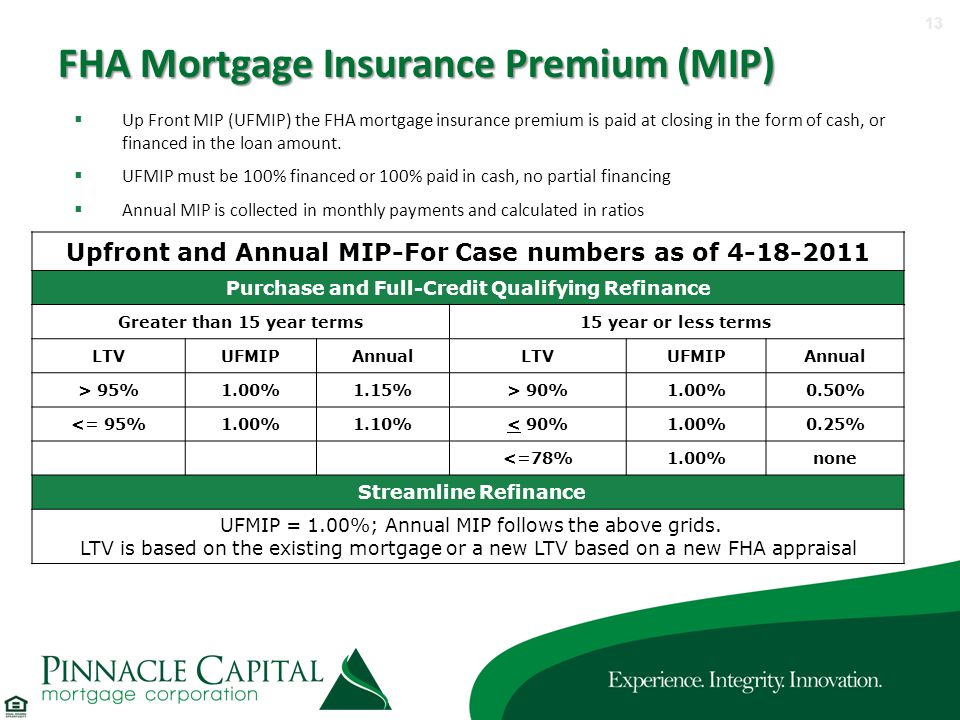

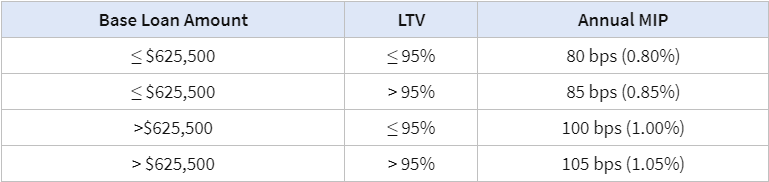

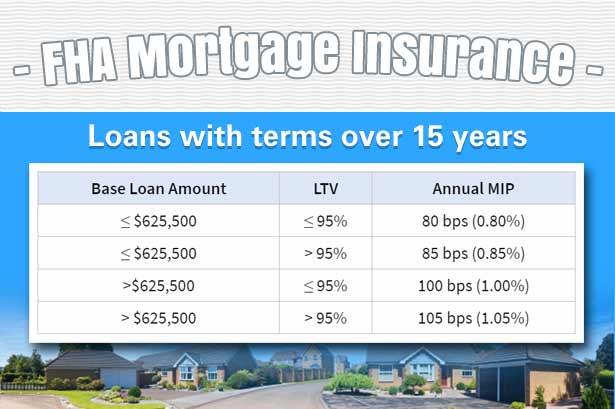

Web The 203b mortgage insurance program or the Basic Home Mortgage Loan is the centerpiece of all FHA mortgage insurance programs for one- to four-unit residential. Federal Housing Administration FHA loans also require mortgage insurance. As of 2020 the rate varies between 05 and 15 of the loan.

Web What is FHA mortgage insurance premium FHA MIP. Compare Quotes In Centre Today. Borrowers must pay up-front mortgage insurance UFMI 175 of the loan balancealong with.

LendingTree is One of the Nations Largest Online Networks with 700 Lenders. Web Mortgage insurance is required for most FHA loans regardless of the loan amount or down payment. Compare Plans to Fit Your Budget.

Payments start 2500 mo. Web July 1991-December 2000. Web What Is FHA Mortgage Insurance.

The upfront mortgage insurance premium costs 175 of your loan amount and is due at closing. The mortgage loan is funded by a lending institution such as a mortgage company. Web Previous FHA Mortgage Insurance Rules.

Web Key Takeaways. If your origination date falls between these two markers you cant cancel your FHA mortgage insurance premiums. Your MIP will be canceled.

Youll have to pay for it if you get an FHA mortgage or put down less than 20 on a conventional loan. Web How much is FHA mortgage insurance. If youre borrowing 250000 for example your upfront MIP will be 4375 250000 x 175 4375.

Private mortgage interest PMI is required when the down payment on a house is under 20 of the selling price. Web Understanding Mortgage Insurance Premiums in FHA-Insured Loans. With Low Down Payment Low Rates An FHA Loan Can Save You Money.

Mortgage insurance also is typically required on FHA. Looking for Fha Mortgage Insurance. Typically borrowers making a down payment of less than 20 percent of the purchase price of the home will need to pay for mortgage insurance.

Calculate Your Payment with 0 Down. Get Instantly Matched With Your Ideal Insurer. Web If youre considering an FHA loan there are two types of FHA mortgage insurance premiums you should be aware of.

If you took out an FHA loan before that June 13 2012 and after Dec. Get Instantly Matched With Your Ideal Insurer. FHA mortgage insurance premium also known as FHA MIP helps keep the Federal Housing Administration FHA.

Web FHA 203k Rehabilitation Mortgage Insurance Program 203k Program by lenders and consumers. Web Mortgage insurance protects the lender. Get a Free Quote Now from USAs 1 Term Life Sales Agency.

Top 10 Reliable Affordable Plans. The first is a one-time upfront payment you make at the closing. No BKRepo past 3 yrs.

An upfront premium and an annual one. The amount youll pay for both depends on your loan amount. If you dont have the cash you are allowed to roll over the amount into your loan.

Web An FHA Loan is a mortgage thats insured by the Federal Housing Administration. FHA mortgage insurance is government-backed insurance that protects the lender if the borrower defaults on a. The 175 UFMIP applies to most FHA loans no matter the loan amount or term except for.

Youll Sleep Better Knowing Your Mortgage is Insured. Upfront mortgage insurance is a one-time premium that is paid on closing day. Web Today the Federal Housing Administration FHA published Mortgagee Letter ML 2023-04 Electronic Filing of all insurance claims on FHA Title II Single Family Mortgages.

Information provided in response to this RFI will. Web The FHA requires two types of mortgage insurance on its loans. Looking for Fha Mortgage Insurance.

No BKRepo past 3 yrs. 31 2000 HUD allows you to drop mortgage. The ML eliminates paper-based filings and informs mortgagees of the digital claim submission options for all insurance benefit claims on FHA single family forward mortgages.

Web Your FHA loan MIP will involve two payments. They allow borrowers to finance homes with down payments as low as 35 and are especially. Dont Settle Save By Choosing The Lowest Rate.

Annual mortgage insurance is a monthly premium included in your mortgage payment. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Lock Rates For 90 Days While You Research.

There are two types of FHA mortgage insurance. An upfront premium and an additional annual payment. Youll Sleep Better Knowing Your Mortgage is Insured.

Payments start 2500 mo. Top 10 Reliable Affordable Plans. January 2001-June 3 2013.

Fha Requirements Mortgage Insurance For 2023

:max_bytes(150000):strip_icc()/FHAMortgage-593aef96b1c9484e926191d03d3867c0.jpeg)

Fha Mortgage Insurance What You Need To Know

Fha Mortgage Insurance Guide Nextadvisor With Time

Meet Our De Underwriters Ppt Download

Fha Mortgage Insurance Guide Bankrate

Fha Mortgage Insurance Explained Fha Mortgage Source

What Is Fha Mortgage Insurance Moneygeek Com

Mortgage Blog Fha Loans Insurance Premiums Mip Pmi Rates Calculator

Fha Mortgage Insurance Guide Bankrate

Fha Mortgage Insurance Premiums Guidelines On Fha Loans

Fha Mortgage Insurance Who Needs It And How Much It Costs Forbes Advisor

Fha Loan Mip Calculator Estimate Additional Loan Payment Costs Moneygeek

Understanding Mortgage Insurance Home Loans

Fha Loan Mip Calculator Estimate Additional Loan Payment Costs Moneygeek

How Much Is Fha Mortgage Insurance

Fha Mortgage Insurance Lowered By Half Percent In 2015

Fha Mortgage Insurance For 2023 Estimate And Chart Fha Lenders